Introduction

The raw material industry in Germany underwent significant paradigm changes during the last decades. The uranium mining activities of the SDAG Wismut ceased with the end of the Cold War and the loss of the markets in the former Soviet Union and the extensive base metal mining industry within Germany also came to an end in the early 1990s for a number of reasons, ranging from depleted ore deposits to failing world market prices and the heritage of outmoded mines and plants in the former GDR. As a matter of fact all metal mining operations in Germany closed down until 1992. During the same period, the decision was taken by state government to bring the highly active (productive), but state-subsidized hard coal mining industry to an end by 2018, which has been achieved according to plan. In addition, the decision was taken in 2018 to also have closed down all lignite open cast mines in Germany by 2038, which will bear some major challenges both for the affected regions and for a stable energy supply, since Germany is still the world’s number one producer of lignite. Only the rock salt and potash mining industries, after an excruciating merging process following Germany’s reunification in the early 1990s, have proven stable, together with the aggregates, industrial raw materials and spar producers. But here as well, the public awareness of all environmental issues related to mining operations makes it more time-consuming and complicated to obtain the necessary mining licenses. Mining companies must face major challenges when opening new mines in Germany, especially in the old mining regions with their vivid mining heritage.

The south-eastern part of Germany, especially the states Thuringia and Saxony, has been heavily affected by the turn-down of the local mining industry during the early 1990s. The SDAG Wismut as a GDR-Soviet joint venture company, and formerly the third largest producer of uranium worldwide with more than 46,000 miners on the payroll, stopped production in 1991. Having been transformed into the state owned Wismut GmbH, its sole purpose since then has been the remediation of the former uranium-mining affected areas. With more than 7 bn € having been spent over the last 25 years, and world-leading remediation technologies having been developed and successfully implemented, this task is near completion. The formerly vibrant precious and base metal mining operations in the region, at some places for more than 850 years in operation, could neither compete on the open markets nor had the ability to invest into the necessary technological and environmental upgrades, and thus also closed down. Only a number of small scale underground mines on aggregates and industrial minerals have been kept continuously in operation. Besides these mines, also several highly specialized mine closure and remediation companies are active in securing and safeguarding the remnants of over eight centuries’ intensive mining activities on the surface and underground.

Brief status report on the 4th Mining Boom („4tes Berggeschrey“)

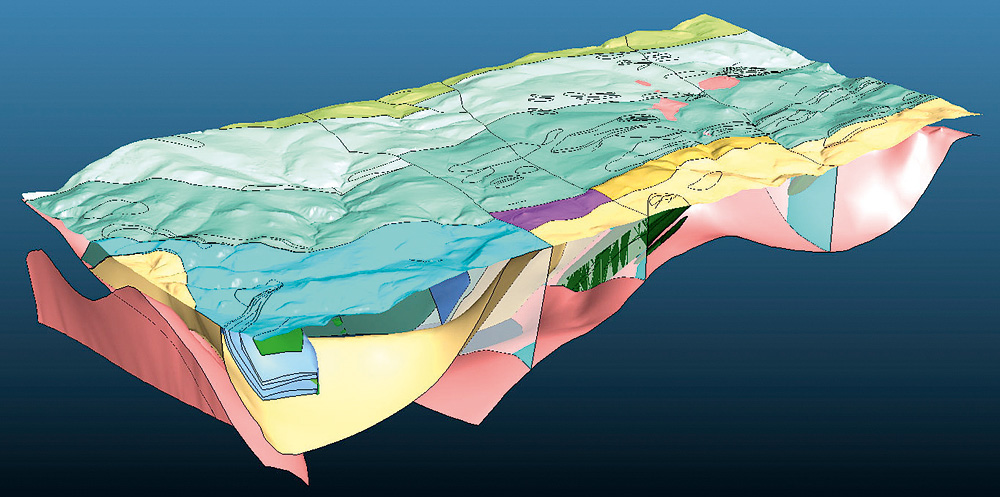

With the new mining projects the enormous value of old exploration and mine data especially from GDR times became obvious. Being bound to the RGW after the Second World War until 1989, the GDR neither had access to free markets nor the exchangeable currencies to import the necessary raw materials for the development of its economy. This, together with the top priority search for uranium deposits, has led to a number of highly ambitious mineral prospection programs throughout the whole country. As an example, SDAG Wismut expended about 5.6 bn Mark (GDR) for the exploration of ore deposits in the GDR leaving Saxony as one of the most intensely prospected regions, at least in Europe. In a couple of new exploration projects it was proven, that these old data match well and show good reproducibility compared to recently acquired data, e. g. as requested by modern standards as Jorc-Code or IN 43-101. As one main activity of the Raw Materials Strategy the project ROHSA 3 (Raw Material Data of Saxony) was initiated. It is designed to save, to exploit, to digitize and to make available all existing raw material informations and data like well data, analysis data, maps and technical reports. By opening this information for the public ROHSA 3 creates high values for the economy, for science and for the technical administration (Figure 1).

In December 2016 a web based search engine was launched by the Geological Survey of Saxony in order to give public access to metadata of documents, maps, drilling data, and to technical informations on deposits and mining activities.

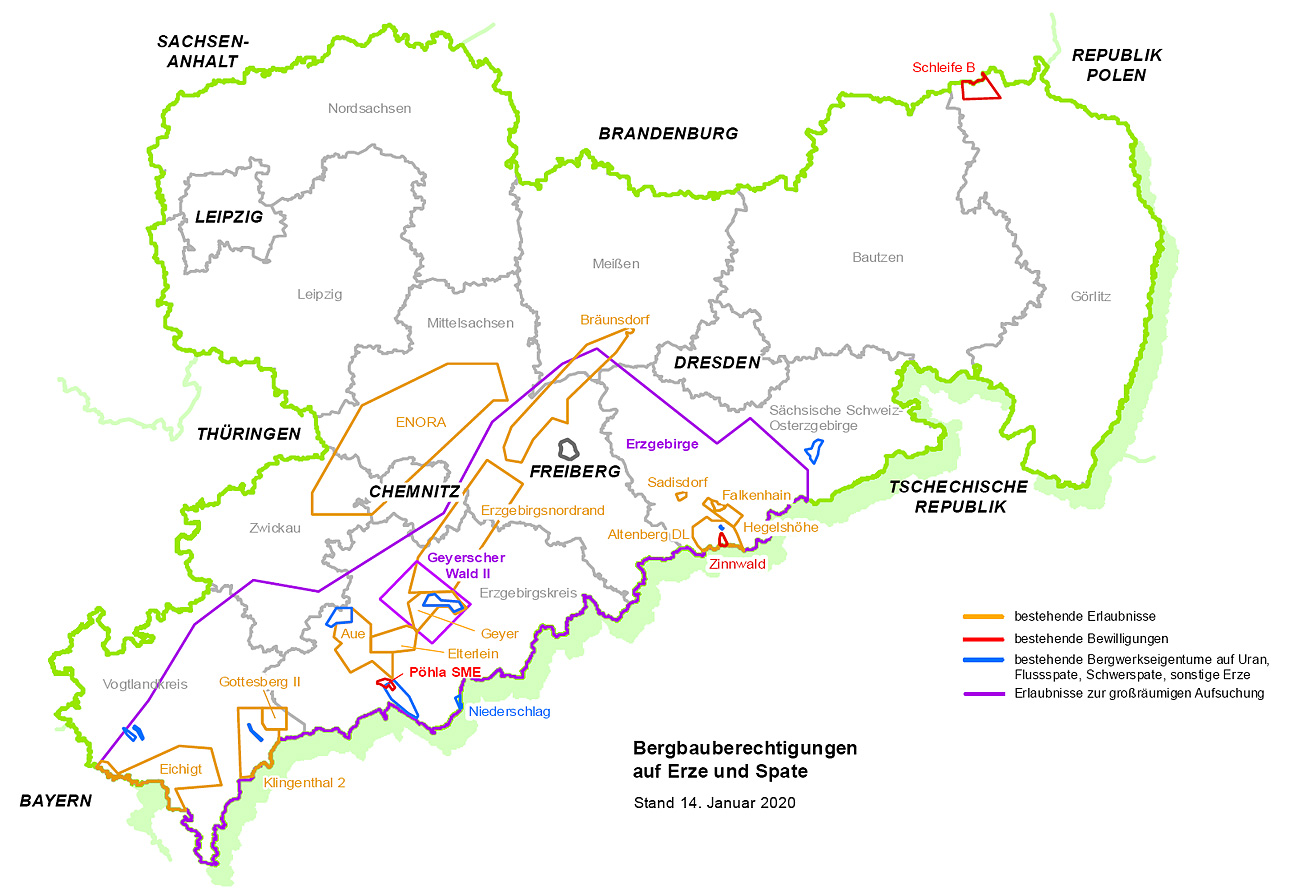

Having access to such a detailed and well-structured data base, numerous prospectors and junior mining companies from the region but also from all over the world have shown interest in the local ore deposits in recent years, especially for the so-called strategic minerals. During the last decade, the State Mining Authority of Saxony (Oberbergamt ) alone has issued over 60 mineral exploration licenses, some of which have been developed into mining projects or have even already become mines in production. A few of them will be presented in figure 2.

The first of the new mines that came into production is the Erzgebirgische Fluss- und Schwerspatwerke GmbH (EFS) in Niederschlag (www.efs-nha.de). While first mining activities for silver and cobalt on today’s mine site started as early as 1650, the steep dipping hydrothermal fluorspar veins have only been found in 1950 as a byproduct of the extensive uranium mining between 1948 and 1954. Small scale mining activities in 1960 have been followed by a detailed geological exploration program until 1991, which allowed local investors to apply for a first mining license in 2008. First mining activities also started in 2008 with the construction of the two access drifts into the orebody. Having come in full production in 2015, the mine produces a pre-concentrate underground which is transported by road to the processing plant in the town of Aue, 35 km away. Today 62 persons are employed in the mine (Figure 3) as well and the processing plant.

The Saxony Minerals & Exploration AG – SME AG (www.smeag.de) obtained its mining license for the polymetallic skarn deposit Pöhla in 2012. Similar to the Niederschlag deposit, this sequence of five skarn mineralized zones has been explored both by drill campaigns as well as underground exploration by the SDAG Wismut, which operated its large scale Pöhla uranium mine in the close vicinity. Out of the five mineralized zones, the three upper zones are considered to be economically mineralized, with the main focus on the tungsten mineralization in zone 4. Currently an exploration shaft has been brought down by a crew of 35 miners into the mineralized zone to allow for large scale sampling. The samples will be transported to the pilot processing plant in the town of Mittweida, in order to fine tune the design of the future processing plant on mine site and to foster a bankable feasibility study for the whole project. In addition to the Pöhla project, SME AG has also obtained prospecting licenses on three more base and rare mineral deposits in the Ore Mountains region.

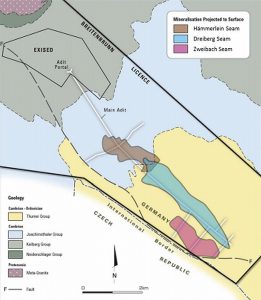

Also in the direct vicinity of the former Pöhla uranium mine, the Saxore Bergbau, a German subsidiary of the British Anglo Saxony Minerals Ltd., has obtained a mineral license on base and rare metals for the Breitenbrunn area. Among a number of different deposits covered by this license, the Tellerhäuser is the main project area. Halfway down the main adit to the Pöhla uranium mine, the highly complex polymineral skarn deposit Tellerhäuser/Hämmerlein was explored and mined during Wismut operations in the 1970s and 1980s, in those days with a main focus on tin. The ore mineralization occurs in three major seam-type ore bodies with a combined strike length of 9 km, an average width of 500 m and an average thickness of 3 m (Figures 4, 5).

During a new assessment of the available data and large scale sampling underground, Saxore could not only prove that the remaining ore has significant zinc, indium and copper mineralization, but also the processability of the ore with today’s focus on zinc and indium. According to Jorc standards, the deposit contains for indium 15.9 Mt at 127 pm In (2,023 t indium) and for zinc the amount of 18.0 Mt at 1,12 % Zn (200,400 t zinc). The focus on the first stage of mining activities lies at the Hämmerlein seam, and with access to the large volume stopes of the previous mining operations, the company is planning to install its whole processing line and tailings underground.

In the eastern part of the Ore Mountains, the Deutsche Lithium GmbH (www.deutschelithium.de) has obtained a mining license for the German part of the tin-lithium-tungsten deposit of Zinn-wald/Cinovec under the German/Czech border. With a total amount of 125,000 t of lithium (according to NI 43-101 standard) in the Lithium-Glimmer-Greisen ore body, and an even larger adjacent Czech ore body, this deposit is considered to be one of the largest lithium deposits in Europe (Figure 6). Deutsche Lithium planned to start construction of the mine in the second half of 2019, with the mechanical processing line installed on the mine site and the chemical process taking place at the BASF Schwarzheide Chemical Park in the neighbouring state of Brandenburg. It is planned that mining and processing operations may employ up to 250 persons, once fully established.

Tasks and challenges for new mining projects

With the beginning of 2019 there are slightly over 20 active mineral and mining licences in total, with several projects presenting their deposit models and calculating their reserves either in bankable feasibility studies or according to international standards. Nevertheless such new mining projects in a densely populated country like Germany, are facing very distinctive tasks and challenges on their way to production.

Legal aspects of the mining boom

Over 850 years mining gave to Saxony raw materials, prosperity, labor, advances in science and technology and cultural identity. Even after more than 25 years without a producing ore mine Saxony retains all structures, networks and regulations needed for a successful re-launch of ore and spar mining. With the Technical University (TU) Bergakademie Freiberg and the State Mining Authority of Saxony in Frei-berg two of the oldest existing mining related organizations in Germany support the new Berggeschrey. A variety of mining companies, consulting engineers, research institutions and scientists are organized under the umbrella of a geo-mining network (GeoCompetenceCentre Freiberg, GKZ).

In Germany mining is regulated in the Federal Mining Act (BBergG) covering all legal aspects from the beginning of exploration until completion of mine closure. For each German state an individual public authority executes the regulations of the Federal Mining Act. In this way the administrative responsibility for most aspects related to mining is concentrated in this single authority.

For the Free State of Saxony the State Mining Authority in Freiberg acts as relevant mining administration. Duties of the State Mining Authority of Saxony cover revision and authorization of all levels of mining permissions. As first stage of permission for mining freely minerable resources mining authorizations have to be granted. The Federal Mining Act differentiates three authorizations with the exploration licence, the extraction licence, and the mining proprietorship. The mining proprietorship accords similar rights as the extraction licence.

Permits for each individual mining operation are applied with operational plans. For a new mine a framework operational plan has to be filed. Depending on the impact of the new mine an environmental impact study has to be conducted as well. All exploration operations, extraction operations and processing operations shall be erected, carried out and terminated only on the basis of operating plans that have been prepared by the mining company and revised as well as approved by the competent authority. These operational plans also serve as basis for mine inspection by the State Mining Authority. Mine inspections cover all relevant impacts of the mine on safety, environment, and health. In addition to the responsibility for enforcement of the Federal Mining Act, the State Mining Authority of Saxony acts as police authoritiy for protection against threats to public safety from old, abandoned mines, tailings and subsurface cavities.

The Free State of Saxony endorses new ore and spar mining. In 2012 the government implemented its Raw Materials Strategy which is oriented along clearly defined guidelines. The principle guideline highlights the common purpose to support new mines that are accepted, well balanced with the environment, realized by applying best practice technologies and economically successful. Other guidelines of the strategy cover aspects and specific activities on topics like research, networking, administration, know-how, education, international cooperation, secondary raw materials as well as public acceptance.

Social acceptance

The cultural history of the Ore Mountains, as stated in the region’s name “Erzgebirge”, is very closely connected to centuries of metal ore mining. Today, this heritage is proudly demonstrated in the many mining related traditions throughout the region, including the distinctive Christmas decorations and the famous miners’ parades in the old mining towns (Figure 7).

These rich and manifold traditions, together with the beautiful landscape, today are fostering a vibrant tourism in the mountainous regions all year round, thus contributing significantly to the local economy.

After the Second World War and throughout the active years of the SDAG Wismut environmental protection played only a minor role compared to the overall goal of uranium mining. Mining operations, processing plants, mine dumps and tailing sites were spreading everywhere, where uranium was to be found. This has led to significant environmental destructions in certain areas, with a total of more than 148 km2 affected (Figure 8). At that time, the population of those areas neither had the rights nor the legal possibilities to act against this destruction. So even today, with most of the affected areas properly cleaned up and remediated successfully (Figure 9), the memory of the destructions is still very vivid in people’s minds and thus the normal population acts mostly restrained or sometimes even highly suspicious when it comes to new mining projects.

This difficult uranium heritage, together with the tourism as an important economical factor and an overall trend in the German public towards a high environmental awareness, is setting high requirements towards the social acceptance of new mining projects in the region. So it is common today for most of the active mines and nearly all new mining projects to minimize the visual and the environmental footprint as far as possible. The crushers and at least part of the processing lines are placed underground (Figure 10), while the final beneficiation process is taking place on established industrial sites and complexes, sometimes several dozen kilometers away. Only a pre-concentrate leaves the mine site towards the beneficiation site, thus ensuring that only relatively small mine dumps are necessary on site during the development phase of the mine, and no tailing dams will be installed close to the mines at all. Whenever possible, tailings and gangue are used as backfill in the mines.

Staffing and equipment challenges

While the region has been significantly shaped by its mining activities over centuries until 1990, today its industrial activities belong mostly to medium sized businesses with a clear focus on the automotive sector. The thriving economy, in all parts and the continuous high demand for highly skilled and trained workforce – e. g. almost all of the German car manufacturers run assembly lines in Saxony – there is a startling shortage of miners for the new mining projects. Today, even the active mines usually only employ a limited number of fully trained and experienced miners (Berg- und Maschinenmann, Bergmechaniker, …), who have successfully completed their two or three year vocational training, and are filling positions with workforce trained on other trades. Thus it is becoming more and more difficult for the mine management to have all necessary competences available on site on all shifts. This needs a high level of staff scheduling, especially for the smaller mines. The large number of miners who have been dismissed nearly thirty years ago from the large scale uranium and base metal mining operations are not available on the job marked any more, either having found other occupations or now being at retirement age.

This situation will become even more crucial once the new mines start their underground development or come into production. This is not only true for the workforce, but also foremen and engineers are on short supply. Already first signs of competition can be observed between employers.

The risk of an insufficient number of workforces has already been identified several years ago at the rise of the 4th Mining Boom. Thus the local vocational training college Julius Weisbach at Freiberg, intensified its efforts and training programs for miners training. In general, job apprentices in Germany will have to spend their full training term both at the training college for obtaining the theories of their trade, as well as in industry for the practical skills, before having to pass a mandatory trade test.

Today, all the actives mines, the Bergsicherungsbetriebe as well as the Wismut GmbH as the largest single employer in the region are facing a generation change in the upcoming years. This fact, together with the required staffing numbers for the new mining operations, leads to a situation that already today the class size at the vocational school does not meet the workforce demand of the mining industry. As a consequence, several activities and programs have been set up recently by government, chamber of commerce, industry and educational institutions to advertise the miner’s profession a sustainable means of living in order to increase intake numbers.

The crucial need for mining technicians at all these mines has even fostered the creation of a new technician class at the vocational training center, in order to form a new generation of foremen and technicians.

Still, with the workforce also being a mayor cost contributor to OPEX of the mines, most mines are also planning to invest into a higher level of mechanization and automation in the near future, in order to overcome this obstacle. While these technologies of Mining 4.0 are being currently developed and implemented worldwide at large scale mines, a suitable technology matching all the needs and demands for the SME-size operations at the Ore Mountains is still under development. Here especially, the possible lack of experienced miners will pose a certain thread to the goal of a modern, highly mechanized mining operation.

Safety and rescue

In the current situation, where new mines with a limited number of staffing and even less experienced miners will come into operation, the organization and implementation of a highly operational and sustainable mine safety and rescue regime will need additional efforts. Traditionally the mine rescue organization has been relying on the large mines in the region like the SDAG Wismut and the large base metal mines, who maintained professional mine rescue structures within their ranks and thus could help and support the surrounding smaller operations.

After 1990, this obligation remained solely with the new Wismut GmbH, who, at one stage, agreed to support a total of 56 independent underground operations and mines in the Federal States Saxony and Thuringia. This was possible as long as the Wismut GmbH was still employing a large number of well-trained and experienced mine rescue troopers within their workforce. Nowadays, with the success of the uranium mining remediation clearly visible and an ongoing generation change within the remaining workforce, this will not be feasible anymore. As a consequence, the Wismut together with two smaller mining companies (EFS and Geomin) and the Bergsicherungsbetrieb BSS Bergsicherung Sachsen founded a new structure in 2014, where each mine provides mine rescue team members out of its workforce into a joint Saxony-wide mine rescue organization. These teams were trained and formed by the Wismut personnel. In 2018 the TU Bergakademie Freiberg (TUBAF) joined the group with its research and educational mine FLB (Figure 11).

In total the new Saxon mine rescue structure provides for 73 mine rescue team members on six mine sites across the state of Saxony. Due to limited staffing at the smaller mines, and the fact that all mine rescue members are volunteers, still not every mine site has a sufficient number of mine rescue troopers available on site to allow for a fast reaction in case of an incident. Also mobilization and travel time to the different sites are quite long over countryside roads, especially during the winter season.

Several concepts have been developed and implemented in the last year in order to deal with these problems. At a regular schedule, all Saxon mine rescue troops are fully cross-trained with exercises in all the different mines belonging to the group in order to allow for a highly flexible and responsive organization. In addition, joint exercises have been held together with mine rescue units from hard coal and salt mines to allow for improved support in case of large scale incidents. At some stage also external emergency units like specialized fire brigade units have been implemented into the structure with great success. This could be proven both during the exercises as well as in several real-life incidents in the course of the last year. As a consequence for those new mines to be developed in the near future, sufficient mine rescue structures must be put in place already during the development phase, a task which is a “conditio sine quae non” for any future operation.

Summary

While the Ore Mountains region is currently experiencing a mining boom for rare, base and strategic minerals, and for that can rely on very supportive and investor-friendly legislation, the overall boundary situation with the expectable shortage of staff, high environmental protection expectations by officials and the public as well as the high requirements on equipment and managerial structures including mine rescue might pose serious challenges to possible investors.

Acknowledgments

Herewith the authors acknowledge the support from all mentioned companies and institutions, whereas all pictures, information and data are accessible on the respectable webpages.

References

References

For more informations visit the following websites: